What Is Credit Score, Factors Affecting & How To Improve It

If you came here to read this article, you should improve your credit score. In this short blog post, you will explore that. Before moving further, let’s understand the exact meaning of a credit score, the factors that affect it, and finally, how you can improve it. So let’s get started.

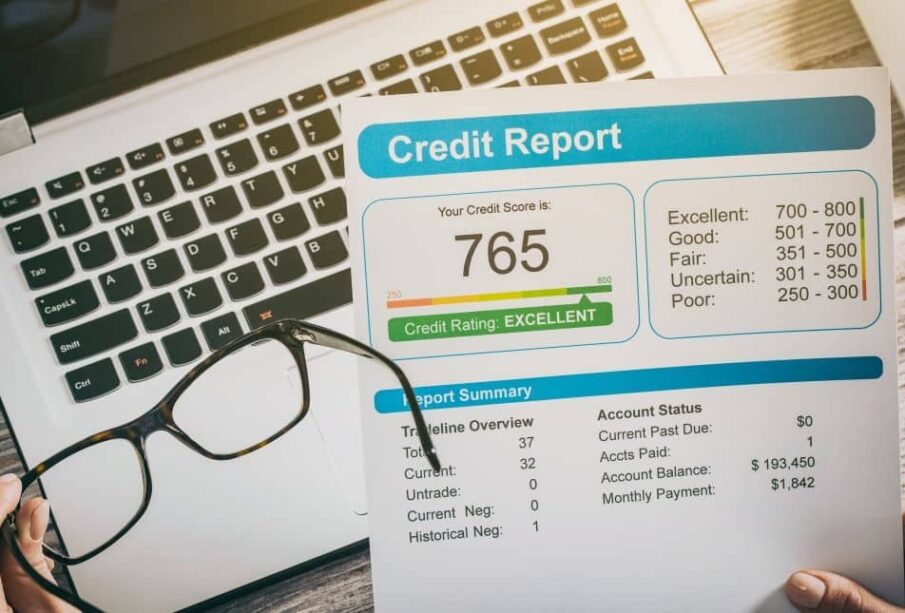

Firstly, a credit score defines your creditworthiness, meaning the higher the score, the better the chance of getting a loan approved for better rates. It is a three-digit number, and Fair Isaac Corporation (FICO) scores range from 300 to 850.

Additionally, it is based on your credit history, which includes your account-related information like total levels of debt, quick bill pay, repayment history, and other factors. While applying for loans, you need to improve your credit score because the money lenders check it, and based on your credit score, you will get the loan. Your good credit score ensures you will repay the amount promptly.

Now, let’s learn about the factors affecting your credit score.

- Payment history: Your payment history gives an idea about when you have repaid your loans, online mobile bill payment, or paid your credit card bill on time. Whether the previous loan was paid, if it was late, how much time you took, etc.

- Amounts owed: Amounts owed are the total sum out of the credit that you have used already compared to the total credit available to you. It is also known as credit utilization.

- New credit: Many money lenders see the new credit as a potential sign you may be desperate for credit. Hence, too many recent applications for credit can negatively affect your credit score.

How to Improve Your Credit Score

Let’s discuss how you can improve your credit score by following a few simple tips:

- Paying your credit card bills on time: At least six months of on-time payments are required to see improvement in your credit score. So it is advisable to pay your credit card bills on time. Furthermore, to pay your bills, you can even use the UPI payment via credit cards.

- Better not close any credit card account: It is suggested by the experts that even if you have stopped using a credit card, do not close your accounts. You can stop using it, as closing an account can negatively affect your credit score depending on a card’s age and credit limit.

- Go for credit repair companies: If you can’t improve your credit score independently, you can always go to credit repair louisville ky companies. They will negotiate with your creditors and various credit agencies for you in exchange for a monthly fee.

By now, you get an idea about credit scores, the factors affecting them, and how to improve them. Your good credit score would help you to get loan approval easily. Additionally, you can get those loans with lesser interest rates, and hence you can save more. So, it advised you to pay your credit card bills on time, not close any credit card accounts, and consider credit repair companies.