How to Open a Share Market Account in 5 Easy Steps and Get a Free Demat Account with Zero Brokerage

Investing in the share market is one of the most practical ways to increase personal wealth. Once considered a risky endeavor, the share market, if approached intelligently, can offer significant returns on investment.

To participate in the share market, you will need to open an account with a reputable and experienced broker. In this blog post, we will outline the steps necessary for opening a share market account and securing a free Demat account with zero brokerage fees.

Why Investing in the Stock Market is a Smart Decision.

Investing in the share market can provide many benefits. Some of the key benefits include:

Portfolio Diversification: Investing in a mix of different financial instruments including shares, bonds, and mutual funds can help spread risk and minimize market volatility.

Potential for High Returns: Historically, the share market has offered high returns to investors over the long term, making it an attractive option for those seeking to maximize growth on their investments.

Regular Income: Some shares, particularly those issued by established companies, also offer regular dividend payments, providing investors with a reliable source of additional income.

Step 1: Choose the Right Broker.

Choosing the right broker for your share market account open is essential to ensure you receive personalized support and guidance that matches your investment goals. Here are some factors to consider before selecting a broker:

Experience and Reputation: Look for a broker with an established track record of providing excellent service, as well as a reputation for integrity and transparency.

Fees, Charges, and Commissions: Consider the broker’s fees and charges, including any transaction or brokerage fees, and determine how they will impact your potential profit from share trading.

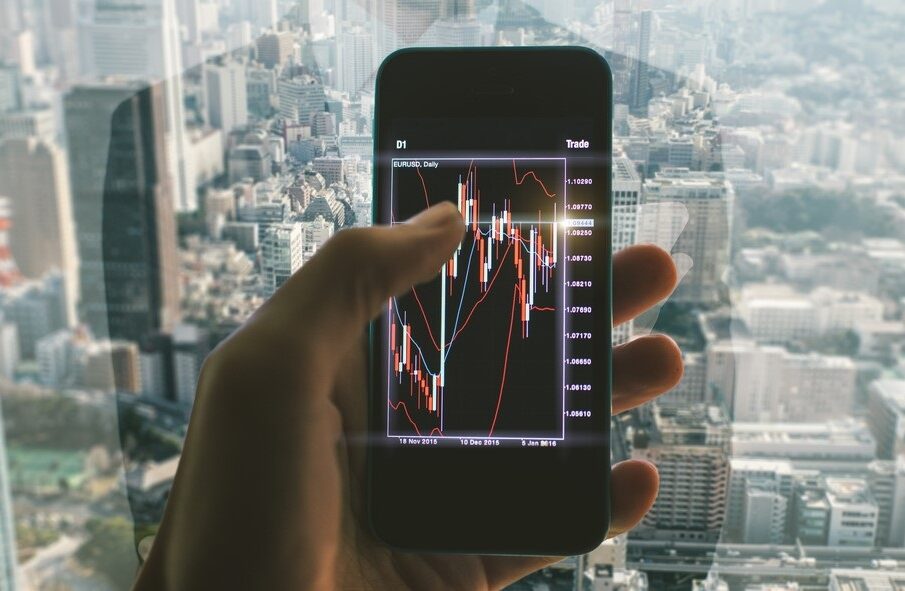

Trading Tools and Platforms: An ideal broker must provide user-friendly trading platforms, as well as a suite of advanced tools and analysis to help investors make informed trading decisions.

Access to Research and Analysis: The best brokers offer comprehensive research reports on various sectors and companies. Leveraging this data can help you make more informed investment decisions.

24/7 Customer Support: The stock market is ever-evolving, and it is essential to have access to expert customer support at any time of the day or night.

Step 2: Fill Out the Account Opening Form.

Once you have selected a broker, you will need to complete their account opening form. The process is typically straightforward, and your broker will guide you through the steps. Ensure that you fill out all the fields accurately and honestly. The following are some of the essential details you will need to fill out on the account opening form:

Personal Information: You will need to provide your full name, address, contact information, and email address, which will be used to verify your account.

Identification Documents: You must submit a self-attested copy of your government-issued identity documents, such as an AADHAAR card, PAN card, or passport, to verify your identity.

Bank Account Details: Provide your bank account details, including the account number, IFSC code, and bank name. This information is vital for transaction and dividend purposes.

Step 3: Submitting the Form and Verifying Your Identity.

After filling out the account opening form, you need to submit it along with the necessary documents to your broker. Once received, the broker will verify your identity and activate your account. Verification of identity is crucial to ensure genuine accounts and prevent fraudulent activity.

Methods of Verification Available to You.

The broker will verify your details by conducting a background check and matching the details on the submitted identification documents with your application form. You may receive a phone call or email to verify your identity.

Alternatively, your broker may use online platforms such as Digilocker or the government’s Central Depository Services Limited to verify your identity using your digital signature.

Step 4: Activate Your Demat Account.

After your identity and account are verified, your broker will create a Demat account for you. Demat accounts are required to hold company shares electronically. The Demat account holds all the shares purchased or sold by the investor in their secure digital vault.

To activate your Demat account and start trading on the share market, you will need to make an initial deposit. You will also need to adhere to the annual maintenance fee and comply with various regulations.

Features of Your Demat Account and How to Use Them.

Your Demat account comes with a range of features to help you manage your share market portfolio better. These features include viewable transaction history, monthly statements, and user-friendly interfaces that provide a wealth of data and analysis to increase your financial understanding.

Conclusion.

Opening a share market account and activating a Demat account can seem daunting. However, with the right guidance and support from a trustworthy broker, the process can be accomplished effortlessly. Remember to take your time, review your broker’s credentials thoroughly, and read through all service agreements to understand your commitments and responsibilities.

Investing in the share market is a wise move, and with the right tools and support, anyone can succeed. Open your share market account today and start your journey toward financial freedom.